VC.

Fund of Funds

The Badger Fund of Funds is a Wisconsin state-backed, public-private venture capital program created to boost the state's startup ecosystem by investing in smaller, local venture capital (VC) funds, acting as a "fund of funds" that co-invests alongside private capital to support early-stage companies across Wisconsin, driving job creation and economic growth.

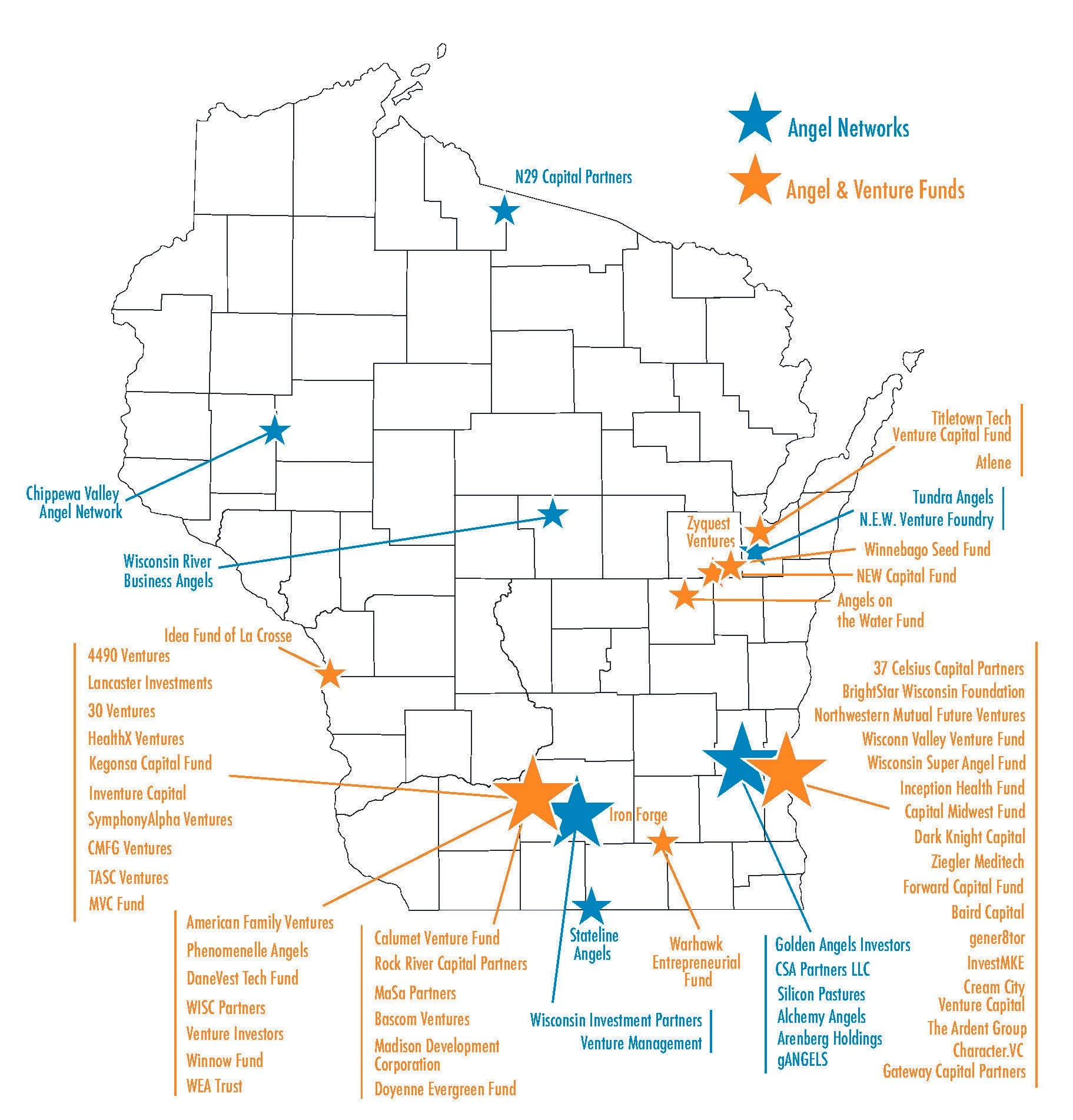

Other Wisconsin-Based Funds:

Additional Non Wisconsin-Based Venture Capital Funds:

Venture capital is funding that helps new and growing businesses develop products, expand operations, and reach customers. It comes from professional investors who provide money in exchange for ownership. Unlike loans, the money doesn’t need to be repaid, but investors expect returns if the company succeeds. Venture capital is common among high-growth startups in fields like technology, healthcare, and advanced manufacturing. Beyond funding, investors often offer experience, connections, and guidance.

For entrepreneurs in Wisconsin and the Midwest, venture capital is becoming more accessible as investors recognize the region’s talent, strong universities, and rising innovation hubs. However, it’s not the right fit for everyone. Because venture capital involves high risk, investors look for companies that can grow quickly and eventually sell or go public. Those who want full control may prefer loans, grants, or angel investors. Still, for founders with bold ideas and strong growth plans, venture capital can provide both financial backing and strategic support to help a local startup scale into a successful business.

Below are some VC funds across Wisconsin. - Make sure to know their respective qualifications and requirements of inquiring businesses when contacting.